Private Real Estate Investment Opportunities

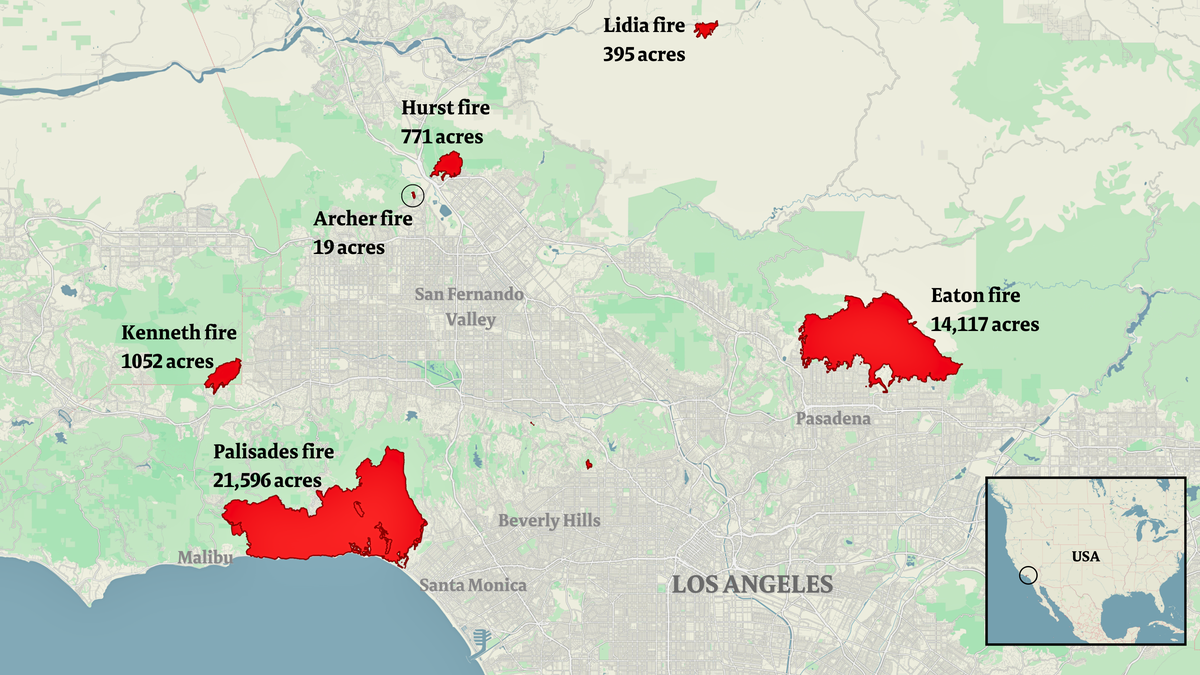

This page describes potential private investment opportunities sponsored by Rolen Development Group, Inc. (“RDG Inc.”), the parent of RolenConstruction LLC. RDG Inc. specializes in special-situation redevelopment projects in established Los Angeles neighborhoods, including areas affected by recent fires such as Pacific Palisades (Palisades Fire) and Altadena (Eaton Fire).

Any securities, if offered, will be offered solely by RDG Inc. under exemptions from registration provided by Rule 506(c) of Regulation D and, for certain non-U.S. investors, Regulation S under the U.S. Securities Act of 1933.

About Rolen Development Group

Rolen Development Group, Inc. sponsors and manages residential redevelopment projects with a focus on special-situation lots, including distressed, underutilized, or fire-damaged properties in the Los Angeles area. Through project-specific special-purpose vehicles (“SPVs”), RDG Inc. provides eligible investors the opportunity to participate in the acquisition, redevelopment, and disposition of these assets, either at the SPV level or directly at the RDG Inc. level.

How the Investment Structure Works

- Investors typically invest through a project-specific SPV that owns a particular property or portfolio.

- RDG Inc. manages the full project lifecycle: acquisition, permitting, construction, and sale.

- Investors have limited liability through their equity interest in the SPV.

- Distributions, if any, are made according to the terms and distribution waterfall defined in the applicable offering documents.

- Opportunities may involve redevelopment of existing structures or new-construction single-family homes.

- RDG Inc. may co-invest alongside investors to align interests, subject to deal structure.

- Investors may elect to invest in RDG Inc. either as a standalone investment or in combination with an investment in an SPV, subject to the terms of the applicable offering.

- Project reporting may include capital account summaries, construction updates, and disposition reporting.

Investor Eligibility

U.S. Investors – Rule 506(c)

Participation in any private offering by RDG Inc. is limited to verified accredited investors as defined in Rule 501(a) of Regulation D. Under Rule 506(c), RDG Inc. may engage in general solicitation; however, securities may be sold only to accredited investors, and RDG Inc. (or its agents) is required to take reasonable steps to verify each investor’s accredited status. No investment will be accepted until such verification has been completed.

Non-U.S. Investors – Regulation S

Subject to applicable law, certain offerings may be made to non-U.S. persons in offshore transactions in compliance with Regulation S. Securities offered under Regulation S have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption.

Key Features of the Investment Strategy

- Focus on infill and special-situation redevelopment in established Los Angeles neighborhoods.

- Project-specific SPV structures that segregate each project’s assets and liabilities.

- Professional management of acquisition, due diligence, entitlement, construction, and exit.

- Investor reporting designed to provide transparency into project status and outcomes.

Nothing on this page should be construed as a guarantee of performance. Any potential returns depend on numerous factors, including market conditions, construction costs, and exit values.

Frequently Asked Questions

Who can invest?

U.S. investors must be verified accredited investors under Regulation D, Rule 506(c). Non-U.S. investors must qualify under Regulation S and any applicable local laws in their jurisdiction.

What is the minimum investment?

Minimum investment amounts vary by offering and are specified in the formal offering documents for each SPV, project, or RDG Inc.–level investment.

How do distributions work?

Distributions, if any, are made in accordance with the distribution waterfall outlined in the relevant offering documents and depend on project performance and available cash following repayment of project or corporate obligations, as applicable.

Are returns guaranteed?

No. All real estate investments involve risk, including the possible loss of principal. Neither RDG Inc. nor RC LLC guarantees any level of return or any recovery of invested capital.

Does this information constitute an offer?

No. This page is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities.

Request Investor Information

If you would like to receive more information about potential investment opportunities sponsored by RDG Inc., please complete the form below. Providing this information does not create any obligation to invest.

The information on this page is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any securities offering by Rolen Development Group, Inc. will be made only pursuant to formal offering materials provided to eligible investors and in compliance with applicable laws and regulations.

Investing in real estate development involves significant risk, including the possible loss of principal. Past performance is not indicative of future results. RolenConstruction LLC does not offer or sell securities and is not an issuer under the U.S. Securities Act of 1933.

© 2025 RolenConstruction LLC. All rights reserved. Terms of Use | Privacy Policy